Table of Content

In case of increase in MCLR on the reset date, the ROI will increase which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer. Download the Axis Mobile Application or log onto Internet Banking to get access to all account details pertaining to the loan. In order to avoid burdening you with a higher EMI, when the rate increased, Axis Bank would have first attempted to increase the tenure of the loan subject to permissible limits. If, however, despite the increase in tenure, the EMI is not adequate to cover the interest payment, then we are entitled to increase your EMI amount. The EMI consists of the principal amount and the interest on the balance outstanding amount. Since only a part of your loan has been disbursed, the interest component of your EMI will be proportionately lower to reflect this.

So we request you to first check for and clear any remaining amount that may be payable towards your Home Loan by requesting a foreclosure statement from your nearest Axis Bank Loan Center. You can switch from a floating rate of interest to a fixed rate of interest and vice versa. Every month, part of the EMI is adjusted towards the interest payable and the balance is adjusted towards repayment of the principal.

What is a home loan interest certificate?

You can check the amount you need to pay as EMI with the Home Loan EMI Calculator. If you are already repaying a home loan and need funds in a hurry, take a top-up home loan.... In case of decrease in MCLR on the reset date, the ROI will decrease which in turn will impact the EMI/tenor of the loan as per Bank’s policy and will be communicated to the customer.

Please check your browser version & upgrade to one of the following browsers to continue banking with us. At your request, you are being redirected to a third party site. Please read and agree with the disclaimer before proceeding further. Axis Bank does not control such websites and bears no responsibility for them. Cover arranged by Axis Bank for its customers under Digit Illness Group Insurance Policy . Invest surplus funds in the account to earn interest and withdraw whenever needed.

Personal

Axis Bank reassesses the BR and MRR from time to time after considering numerous factors including the cost of funds, cost of operations, prevailing interest rates, and provisioning requirements. Various Builder/Developer who have advertised their products. Magicbricks is only communicating the offers and not selling or rendering any of those products or services. It neither warrants nor is it making any representations with respect to offer made on the site. We hope that by now, you have a clear idea regarding how to fetch an Axis Bank home loan statement both through online and offline mode. The loan statement shows the loan’s time frame during which the transactions are summarised.

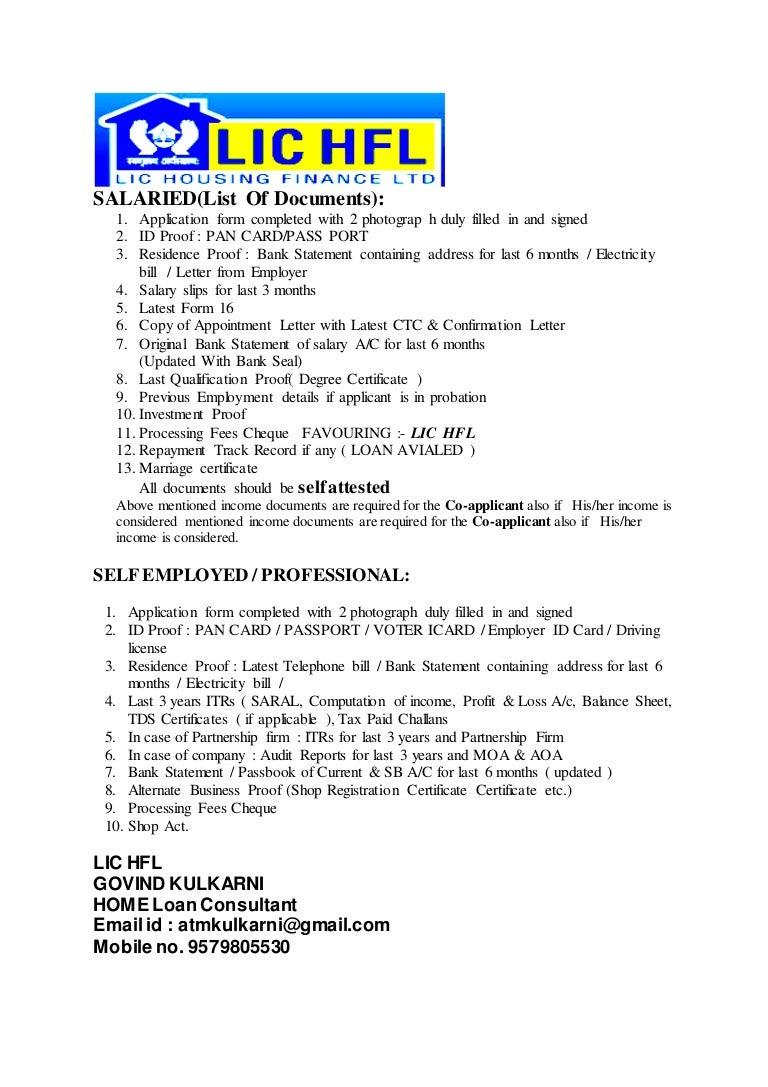

Request your loan statement by entering your registered email address and cellphone number. As is common knowledge, both the principle and the EMI portions of a home loan qualify for their own separate tax deductions. You are allowed to claim a deduction for the principal amount that you have repaid up to a maximum of Rs. 1,50,000 under the provisions of Section 80C of the Income Tax Act. Click below to download the list of documents mentioned above. Professionals (i.e., doctors, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, and management consultants only) meet the Axis Bank Home Loan eligibility criteria. Applicants should be above 21 years of age at the time of loan commencement and up to the age of 60 or superannuation, whichever is earlier at the time of loan maturity.

How can I see my Axis Bank home loan statement online?

Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. When you arrive at the branch, you can ask for the home loan statement form. Include all relevant information, including the applicant’s name, PAN number, DOB, residence address, home loan details, applicant’s email address, and contact information. The statement of house loan from Axis Bank eventually appears after inputting the details.

On signing up for an E-Statement, you are eligible to receive consolidated account statement under your customer ID. These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes.

Shubh Aarambh Home Loan

The reset period and date will be decided on the date of first disbursement. Property papers will be handed over to you at Axis Bank Loan center within 15 days from the date of repayment of all dues. Yes, resident Indians are eligible for tax benefits on both the principal and the interest of a Home Loan under the Income Tax Act. To check your eligibility online, please click here for check your eligibility online. Axis Bank shall not be liable or responsible for any breach of secrecy caused as a result of the e-statements being sent to the registered email with the Bank. Free monthly e-statement and other regular notices/advices/updates/information will be sent to the registered email id.

This particular statement very clearly includes the principal amount borrowed, the interest that is being charged by the bank and the home loan’s tenure, the unpaid principal amount, payment breakdown etc. Axis Bank home loan borrowers can view all the details about their Bank home loan statement. In this specific statement, the principle borrowed, the interest the bank is charging, the length of the mortgage loan, the remaining principal balance, the breakdown of payments, etc., are all clearly stated. This document is also known as the Axis Bank home loan provisional certificate. Request a form for a home loan statement, and be sure to fill it out with all the necessary information accurately.

MCLR is the benchmark rate below which the banks cannot provide loans to the customers who are availing loans linked to MCLR. This new benchmark rate is applicable for new loans sanctioned & credit limit renewed from April 1, 2016 onwards. Schedule monthly e-statements and receive e-statement for personal banking right on your smartphone or laptop. You can also get instant access to your e-statements by logging on to the official website, internet banking or sending a simple SMS. Axis Bank home loan statement is a financial statement that is released by Axis Bank to their existing home loan customers. The Axis Bank Home Loan Statement gives you a view of the several components of your home loan.

If you are on a fixed rate of interest, please check the charge applicable by clicking here If you are on a fixed rate of interest, please check the charge applicable. Magicbricks is a full stack service provider for all real estate needs, with 15+ services including home loans, pay rent, packers and movers, legal assistance, property valuation, and expert advice. As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. After entering the information, Axis Bank’s statement of home loan finally opens.

The EMI may be subject to change when interest rate changes or a part-payment of the Loan is made. Home loan statement of Axis Bank gives details of the loan including Customer ID, customer details like PAN number, date of birth and loan account number. The loan statement is usually sent via email or can also be attained online. The Axis Bank housing provisional certificate is available in hard copy and digital formats. To use Axis Bank's offline services, you need to visit your local branch. Conversely, you can use online banking websites to access these services.

Further, the Bank shall have absolute right to decide and apply the spread over the REPO rate, ”Spread” shall consist of credit risk premium , operating costs and other costs. The spread will be reset periodically once in three years from the date of disbursement. Your credit risk premium shall be reviewed by the Bank at regular intervals and shall undergo a revision in case of a substantial change in your credit assessment. Total Processing fees of 1% of the outstanding principal with a minimum of Rs. 10,000 plus GST as applicable will be charged. Upfront processing fee of Rs 5000 plus GST shall be collected at the time of application login. This fee will not be refunded under any circumstances such as loan rejection/withdrawal of the loan application etc., non disbursement of loan for the reasons solely attributable to the customer.